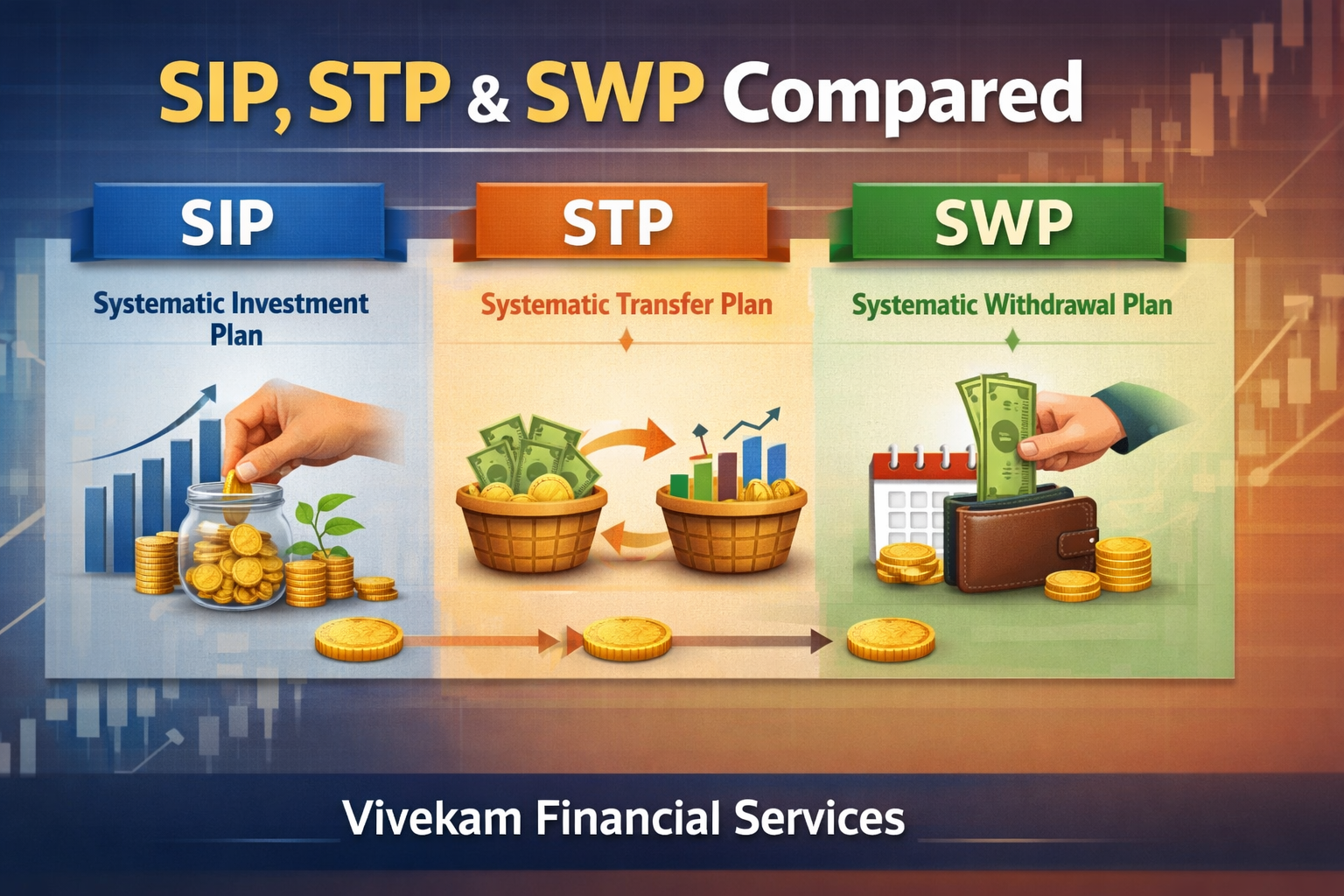

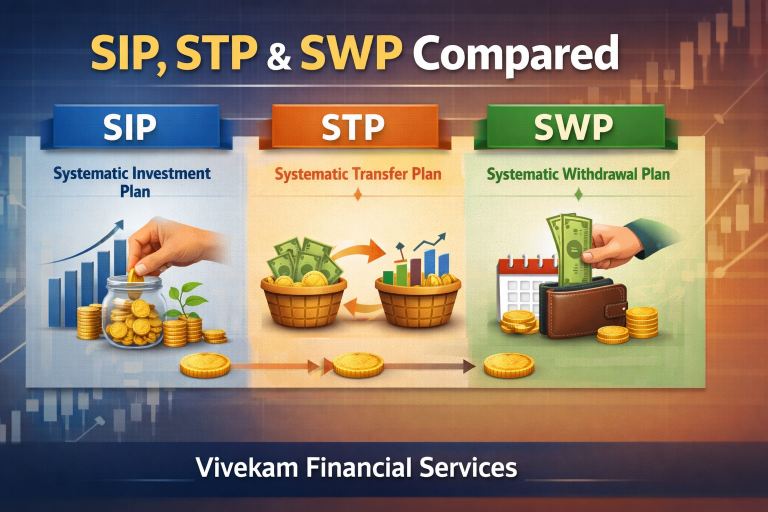

SIP, STP & SWP: Benefits, Risks

Introduction to Systematic Mutual Fund Strategies

Mutual fund investing isn’t complicated—but poor understanding makes it feel that way. Terms like SIP investment, STP investment, and SWP investment are often used interchangeably, even though they solve completely different financial problems.

This is where most investors go wrong.

This guide on SIP, STP & SWP Compared: Benefits, Risks focuses on how these strategies actually work in real life, when to use each one, and—most importantly—what can go wrong if you use the wrong approach at the wrong time.

What Is SIP Investment?

Meaning of Systematic Investment Plan

A systematic investment plan (SIP) is a method of investing a fixed amount into a mutual fund at regular intervals. Instead of worrying about market timing, SIP investment spreads your entry across multiple market cycles.

In simple terms: you invest consistently, regardless of whether markets are up or down.

How Mutual Fund SIP Works

A mutual fund SIP automatically invests a chosen amount from your bank account into a selected fund. Over time, this results in purchasing units at different price levels, smoothing out volatility.

This makes SIP investment especially suitable for long-term goals like retirement or children’s education.

Types of SIP in Mutual Funds

- Regular SIP – fixed amount, fixed date

- Top-up SIP – increasing contribution over time

- Flexible SIP – variable investment amount

- Perpetual SIP – no fixed end date

Each variation exists to match different income patterns—not to complicate things.

SIP Benefits Explained

Power of Compounding

The most talked-about SIP benefit is compounding. But compounding only works when two things exist: time and discipline. SIP investment forces both.

The earlier you start, the more meaningful this benefit becomes.

Rupee Cost Averaging

Rupee cost averaging reduces emotional investing. You buy more units when markets fall and fewer when they rise—without trying to predict anything.

This doesn’t eliminate losses, but it reduces poor timing decisions.

Financial Discipline

SIP investment removes decision fatigue. You don’t “decide” every month—you just invest. Over time, this discipline matters more than returns.

SIP Risks You Should Know

Let’s be clear: SIP is not risk-free.

Key SIP risks include:

- Market risk (especially in equity funds)

- Underperforming or poorly managed funds

- Long periods of low returns

- Investors stopping SIPs during market crashes

SIP reduces timing risk—not investment risk.

What Is STP Investment?

Meaning of Systematic Transfer Plan

A systematic transfer plan (STP) is designed for investors who already have a lump sum. Instead of investing it all at once, STP investment gradually moves money from one fund to another.

Typically, funds are transferred from debt to equity.

How Mutual Fund STP Works

In a mutual fund STP, you invest a lump sum in a low-risk fund and systematically transfer a fixed amount into a higher-risk fund.

This strategy is commonly used during volatile or uncertain markets.

STP Benefits and Use Cases

Key STP benefits:

- Reduces lump sum timing risk

- Allows better capital deployment

- Useful during uncertain market phases

- Combines stability with growth potential

STP investment is strategic—not automatic like SIP. It requires planning.

STP Risks Involved

STP risks are often underestimated:

- Each transfer is a taxable event

- Exit loads may apply

- Market risk still exists in the target fund

- Requires correct fund selection

STP is not a shortcut—it’s a risk-management tool.

What Is SWP Investment?

Meaning of Systematic Withdrawal Plan

A systematic withdrawal plan (SWP) allows investors to withdraw money at fixed intervals from a mutual fund investment.

Think of SWP investment as converting your accumulated corpus into a controlled income stream.

How Mutual Fund SWP Works

In mutual fund SWP, units are redeemed periodically, and money is credited to your bank account. Only the withdrawn portion is affected—not the entire investment.

SWP Benefits for Investors

Important SWP benefits include:

- Predictable cash flow

- Better tax efficiency than lump sum withdrawals

- Suitable for retirees and income seekers

- Flexible withdrawal structure

SWP investment works best when paired with conservative return expectations.

SWP Risks You Must Consider

Common SWP risks:

- Capital depletion if withdrawals are too high

- Market downturns reducing portfolio value

- Inflation eroding purchasing power

- Poor fund performance over time

SWP is sustainable only if returns exceed withdrawals.

SIP vs STP vs SWP – Detailed Comparison

Aspect | SIP | STP | SWP |

Primary Goal | Wealth creation | Risk-managed entry | Regular income |

Cash Flow | Inflow | Internal transfer | Outflow |

Ideal Investor | Salaried earners | Lump sum investors | Retirees |

Risk Level | Market-linked | Moderate | Withdrawal-dependent |

This table summarizes SIP vs STP vs SWP without confusion.

How to Choose Between SIP, STP, and SWP

Choose SIP investment if you:

- Earn regular income

- Have long-term goals

- Want simplicity and discipline

Choose STP investment if you:

- Have a lump sum

- Want controlled market entry

- Are risk-aware

Choose SWP investment if you:

- Need consistent income

- Want tax efficiency

- Have an existing corpus

Taxation Rules for SIP, STP, and SWP

- SIP: Tax depends on fund type and holding period

- STP: Each transfer is treated as a redemption

- SWP: Only capital gains portion is taxed

Tax efficiency improves when withdrawals are planned, not rushed.

FAQs on SIP, STP & SWP

1. Is SIP investment safer than lump sum investing?

SIP investment reduces timing risk, not market risk.

2. Can STP replace SIP?

STP works better for lump sums, while SIP suits regular income.

3. Is SWP investment good for retirement?

Yes, if withdrawal rates are sustainable.

4. What are the biggest SIP risks?

Market volatility and emotional discontinuation.

5. Are STP risks higher than SIP risks?

They depend on taxation and fund selection.

6. Can SWP exhaust capital?

Yes—poor planning leads to capital erosion.

Conclusion: SIP, STP & SWP Compared – Final Thoughts

The debate around SIP, STP & SWP Compared: Benefits, Risks isn’t about which is better—it’s about which fits your situation.

- SIP investment builds wealth steadily

- STP investment manages lump sum risk

- SWP investment converts wealth into income

Used correctly, these strategies complement each other. Used blindly, they disappoint.