How Indian Startups Can Claim 100% Tax Exemption Under Section 80-IAC

Introduction to Section 80-IAC Tax Exemption

The Indian startup ecosystem is rapidly evolving, with government-led initiatives like the Startup India Scheme paving the way for innovation and entrepreneurship. One of the most compelling benefits under this scheme is the 100% tax exemption under Section 80-IAC. This provision offers a major incentive for eligible startups, allowing them to reinvest profits and scale faster.

Whether you’re a budding entrepreneur or a seasoned founder looking to optimize your tax strategy, understanding Section 80-IAC is essential for smart startup tax planning in India.

What is Section 80-IAC?

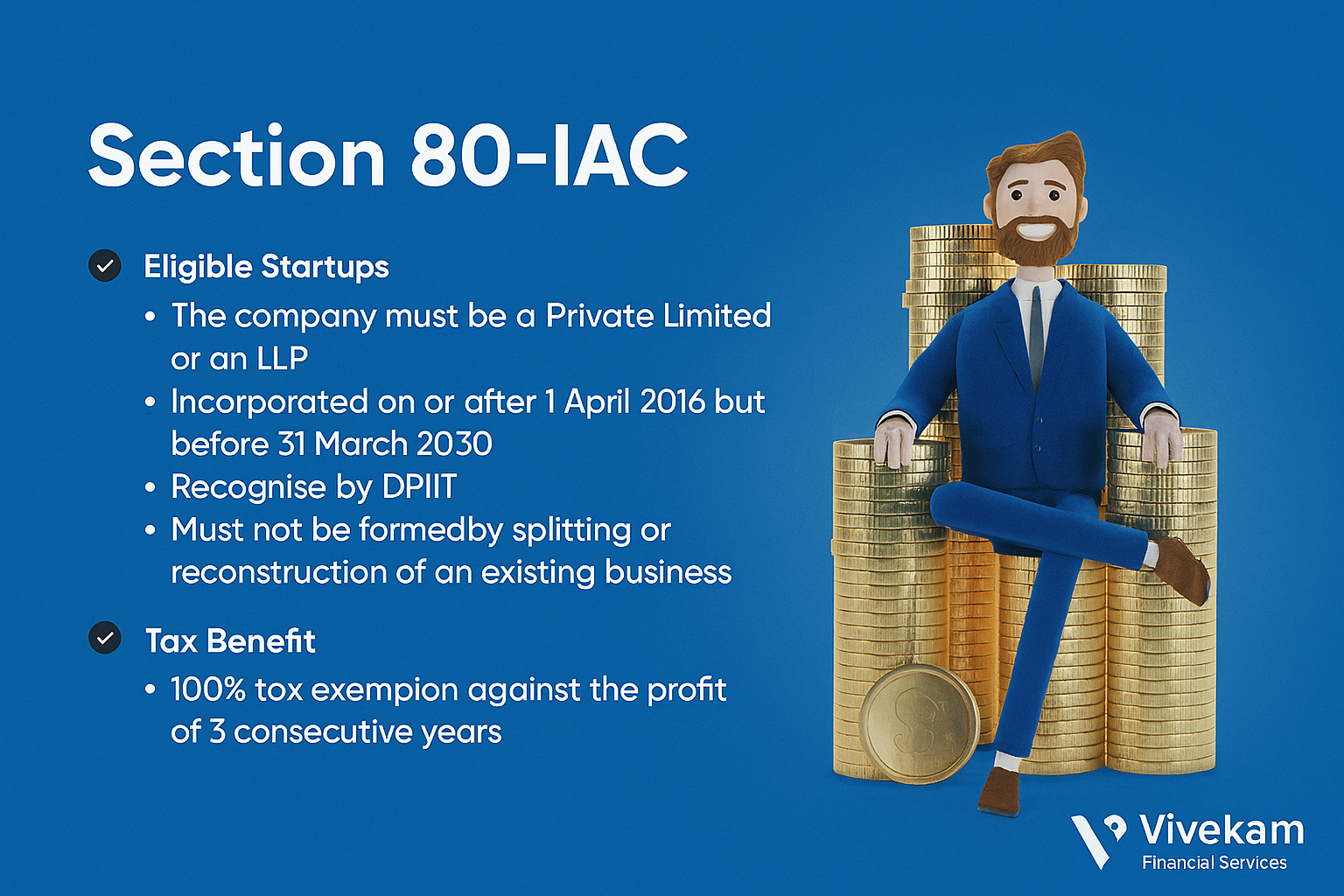

Section 80-IAC of the Income Tax Act, 1961 offers tax holiday benefits to startups recognized by the Department for Promotion of Industry and Internal Trade (DPIIT). It allows eligible startups to claim 100% income tax exemption for any 3 consecutive financial years out of the first 10 years from incorporation.

This exemption is aimed at helping startups retain capital for innovation, team expansion, and growth—fostering a business-friendly environment in India.

Eligibility Criteria for Section 80-IAC

To claim the exemption under Section 80-IAC, startups must fulfill certain criteria set by the government.

-

- Must be a Private Limited Company or LLP

- Incorporated on or after April 1, 2016

- Must be recognized by DPIIT

- Annual turnover should not exceed ₹100 crores in any previous year.

- The business should be focused on innovation, development, or improvement of products or services

- Must not be formed by splitting or reconstructing an existing business

- Should not be engaged in businesses listed under the blacklist (e.g., liquor, tobacco, etc.)

Importance of DPIIT Recognition for Startups

DPIIT recognition is a prerequisite to claim any benefit under the Startup India scheme, including the Section 80-IAC exemption.

- Register on Startup India Portal: Visit www.startupindia.gov.in

- Incorporate your Entity: Ensure it is registered under MCA as Pvt. Ltd. or LLP.

- Prepare Documents: Include business pitch, innovation explanation, and certificates.

- Apply for Recognition: Submit form and documents on Startup India portal.

- Get DPIIT Certificate: If approved, you’ll receive the recognition certificate.

Once this is complete, the startup becomes eligible to apply for the tax exemption.

Step-by-Step Guide to Claim Section 80-IAC Tax Exemption

Here’s a simplified path to claiming this lucrative exemption:

- Obtain DPIIT Recognition

- File Form 1 with the Inter-Ministerial Board (IMB)

- Submit necessary documents:

- Certificate of Incorporation

- DPIIT recognition letter

- Annual accounts for the 3 previous years (if applicable)

- Income Tax returns

- Wait for IMB approval

- Claim exemption in ITR filings once approved.

Common Mistakes to Avoid When Filing for Exemption

Even promising startups can miss out on the exemption due to avoidable errors. Here’s what to watch out for:

- Failure to obtain DPIIT recognition

- Incorrect or incomplete documentation

- Missing IMB approval before tax filing

- Late filings and missed deadlines

- Engaging in blacklisted business activities

- Failure to meet compliance during the claim period

Avoiding these pitfalls can ensure smooth access to startup tax benefits in India.

Startup Tax Benefits India: Beyond Section 80-IAC

While Section 80-IAC is powerful, it’s not the only tax benefit available:

- Section 56(2)(viib) – Angel Tax exemption for DPIIT-recognized startups

- R&D Tax Deductions – For startups investing in innovation

- Capital Gain Exemptions (Section 54GB) – On investment in eligible startups

- Lower Corporate Tax Rates – For new manufacturing companies

Smart startups leverage a combination of these to build an efficient tax strategy.

Startup Financial Planning in India

Tax exemptions are just one part of the puzzle. A comprehensive startup financial planning strategy includes:

- Budgeting and Forecasting

- Cash Flow Management

- Regulatory Compliance

- Investment Planning

- Scaling Operations Sustainably

Professional financial guidance is crucial for long-term success, especially during early growth stages.

FAQs on Section 80-IAC Tax Exemption

- Can all startups claim Section 80-IAC exemption?

Only DPIIT-recognized startups that meet the eligibility conditions can claim it.

- How many years is the tax exemption valid for?

You can claim 100% tax exemption for any 3 consecutive years out of the first 10.

- What is the maximum turnover allowed to claim this benefit?

The startup’s turnover must not exceed ₹100 crores in any previous year.

- Is DPIIT recognition mandatory to claim this exemption?

Yes, it’s a compulsory requirement.

- What happens if I miss the IMB approval step?

Your claim for exemption will be rejected even if you’re otherwise eligible.

- Can Vivekam Financial Services help with both DPIIT and IMB approvals?

Yes, we provide comprehensive support from recognition to exemption claims.

Disclaimer

This content is for informational purposes only and not tax or investment advice. Please consult a qualified professional or reach out to Vivekam Financial Services for personalized guidance.