India’s 6-Week Stock Market Meltdown: Real Reasons Behind the Crash & 7 Smart Moves for Investors

The Unprecedented 6-Week Slide

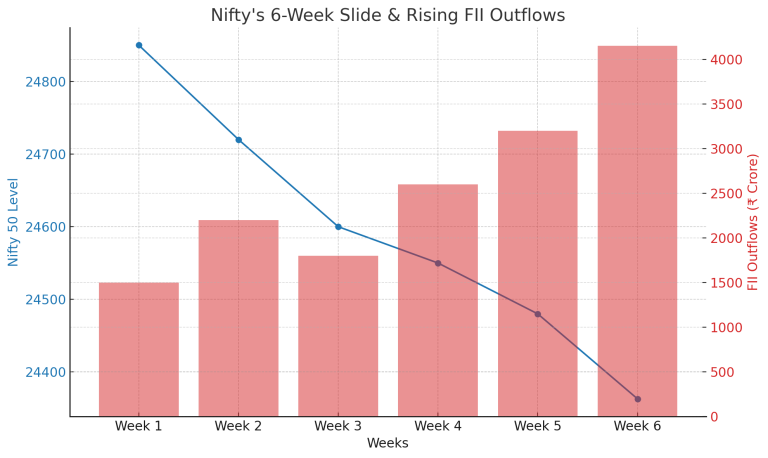

India’s stock markets have endured their longest weekly losing streak since April 2020, with both the Nifty 50 and Sensex extending declines for a sixth consecutive week. Last week alone, the Nifty slipped 0.95% to around 24,363, while the Sensex hovered near 79,858 (as of August 11, 2025).

This isn’t routine volatility — it’s a sustained sell-off testing investor conviction and portfolio resilience.

Understanding the Recent Market Downturn

Key Economic Indicators Pointing to Weakness

Industrial output remains sluggish, inflation is stuck above the RBI’s 4% comfort zone, and global rate pressures are muting growth optimism. The latest manufacturing PMI shows slowing momentum — a warning sign for future earnings.

Global Market Sentiments Affecting Indian Equities

Escalating U.S. tariffs are rattling global trade flows, while a slowdown in China’s growth has weakened overall market sentiment. Wall Street volatility is also spilling over to emerging markets.

The Role of Foreign Institutional Investors (FIIs)

FIIs turned aggressive net sellers, offloading ₹4,997 crore in a single day on August 7 — taking monthly outflows over ₹15,950 crore in just 10 days. This exit not only pressures equity prices but also weakens the rupee, amplifying import costs.

Domestic Factors Driving the Slump

How Rising Prices & RBI’s Next Move Could Keep Markets Down

Persistent inflation has raised expectations of further rate hikes. Higher borrowing costs hurt corporate margins and dampen consumer spending.

Muted Earnings & Downgraded Forecasts

Blue-chip heavyweights like Infosys and HDFC Bank have delivered underwhelming quarterly results, prompting analysts to cut growth projections.

Policy Uncertainty & Regulatory Shocks

Sudden changes in tariff structures and capital gains taxation have injected unpredictability into market outlooks.

Sector-Wise Impact of the Losing Streak

IT Sector: Global Budget Cuts, Local Hit

Indian IT giants, heavily reliant on U.S. and European clients, are facing tighter client budgets amid global slowdown fears.

Banking & Finance: Rising Stress Tests

Slowing credit growth and creeping NPAs are weighing on valuations, particularly for mid-cap lenders.

Auto & Manufacturing: Exports Fall, Demand Weakens

Weak export orders and tepid rural demand are creating headwinds, despite marginal urban recovery.

Historical Perspective: Similar Market Downturns in India

2008 Crash: The Benchmark for Brutal Drops

The 2008 global financial crisis saw markets plunge over 60% before recovering over three years — a reminder of both risk and resilience.

2020 Crash & Swift Rebound

The COVID crash erased years of gains in weeks, but record stimulus drove one of the fastest recoveries in market history.

Investor Psychology During Prolonged Bearish Phases

Panic Selling vs. Strategic Rebalancing

History shows that panic exits often miss the market’s strongest rebound days, which typically occur close to bear market bottoms.

The Sentiment Cycle: Fear, Gloom, and Opportunity

Investor emotions swing from fear to optimism — disciplined investors exploit these cycles rather than get trapped by them.

Risk Management Strategies in a Slumping Market

Diversification and Asset Allocation

Balancing equities with debt, gold, and other alternatives helps reduce portfolio drawdowns.

Why FMCG & Utilities May be Your Crash Shield

Defensive sectors like FMCG and utilities tend to deliver steadier returns when broader markets tumble.

SIPs & Rupee Cost Averaging: Turn Dips into Entry Points

Continuing systematic investments during down phases helps average down costs and capture upside when markets recover.

Action Plan for Retail Investors

Evaluating Portfolio Exposure

Reduce exposure to volatile mid- and small-caps. Focus on large-cap leaders with strong balance sheets.

Opportunities in Undervalued Sectors

Watch for long-term plays in renewables, pharmaceuticals, and domestic consumption-driven stocks.

Importance of Staying Invested

Missing even the best 10 recovery days over a decade can slash returns by half — patience is a competitive edge.

7 Smart Moves for Investors During a 6-Week Losing Streak

When markets stay under pressure, these moves can help you stay strategic — not emotional:

- Continue SIPs (Systematic Investment Plans) – Dips lower your average buying cost.

- Rebalance Toward Quality Large-Caps – They offer better resilience in downturns.

- Diversify Across Asset Classes – Spread risk across equities, debt, and gold.

- Boost Allocation to Defensive Sectors – FMCG, healthcare, and utilities often hold steady.

- Scout Undervalued Sectors – Renewables, pharma, and domestic plays present opportunities.

- Avoid Panic Selling – Rushed exits can lock in losses before a rebound.

- Maintain a Long-Term Lens – Market history shows eventual recovery — even from deep slumps.

What Experts Are Saying About the Road Ahead

Short-Term Volatility Expectations

Analysts see resistance at 24,600–24,800 on the Nifty and key support near 24,000. Until macro data improves, sideways or downward bias may persist.

Long-Term Growth Projections Still Intact

India’s demographic advantage, digital transformation, and infrastructure pipeline remain powerful drivers for future growth.

FAQs

Why the 6-week losing streak?

A convergence of tariffs, FII outflows, and weak corporate earnings.

Stop SIPs now?

No. SIPs benefit most during downturns via rupee cost averaging.

Best defensive sectors right now?

FMCG, healthcare, and utilities.

How to shield my portfolio?

Diversify, avoid emotional selling, and rebalance strategically.

Will markets bounce back?

History suggests eventual recovery barring systemic shocks.

Is gold a good bet now?

Yes — it often rallies during equity market stress.

Conclusion: Weathering the Storm with a 3-Step Plan

Six weeks of declines can test even the most disciplined investors, but history shows that periods of fear often sow the seeds for the next rally.

- Stay invested wisely — Maintain SIPs and selectively rebalance.

- Lean into defensive sectors — Use stability to protect your core portfolio.

- Keep your horizon long-term — India’s growth fundamentals remain intact despite short-term turbulence.

By combining patience with strategy, investors can not only survive the current slump but position themselves to thrive when recovery inevitably comes.