-

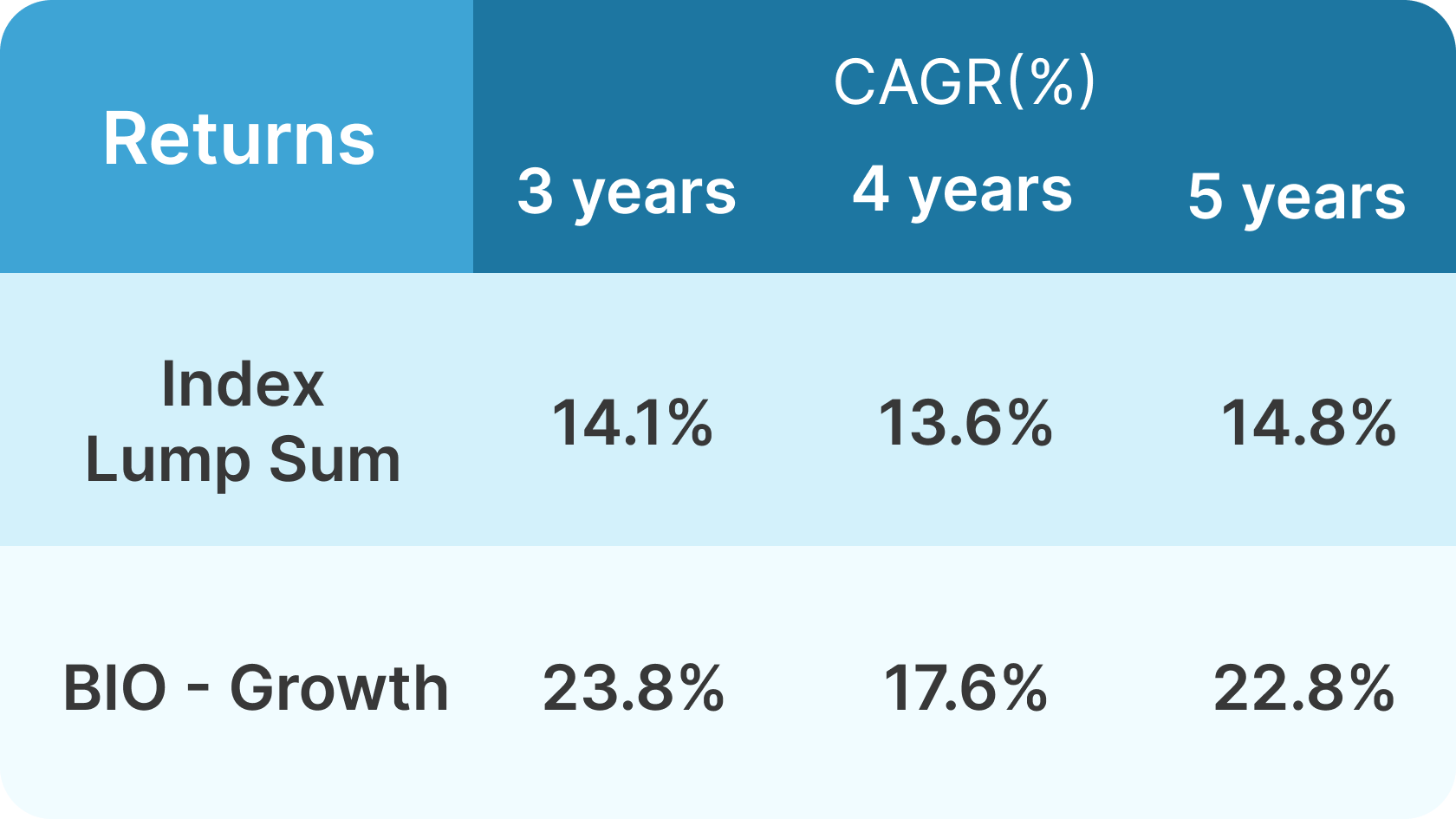

BIO-Growth is based on a strategy that allows creation of a portfolio of growth oriented stocks which are allowed to run their full course of profit.

Like other Vivekam products, BIO-Growth can also be customized to suit client’s personal needs by allowing the client the choice of number of stocks in his portfolio. Portfolio protection through appropriate diversification among industries is built in all products of Vivekam.

The stocks in the portfolio shall be reviewed several times during the day for price action and once every quarter to ensure productivity of the stocks in portfolio. Sale of stocks is suggested only when the stock price reaches the perceived price level as defined by Vivekam’s Stock Value Logic or when the operating results fail to enthuse. Dividends on the stocks are directly credited in bank accounts of the investors. Cash from sale of stocks from portfolio is parked in Liquid Bees till next quarter results come out to help us spot worthy stocks.

Minimum Investment Size into BIO-Growth is Rs 50,000. SIP (Monthly) version i.e SMILES - Growth has a Minimum Investment Size of Rs 5,000.

-

Originally created during the COVID-19 crisis, baskets were meant to take advantage of the attractive investment opportunities possible through investing in the right sectors. Since that time, we have been identifying newer theme based investment options that fit well with the values of the investors combined with greater growth potential.

Each of our baskets are carefully curated to heavily rely on underlying fundamentals of stocks combined with Vivekam’s expertise on research and backtesting. Each theme is unique in the underlying factors that contribute to stock selection.

Vivekam’s baskets are meant to be short lived investment opportunities (1-2 Years) that have in-built diversification on the number of stocks that are invested into so as to protect against volatility in a particular stock. After due research from Vivekam, stocks are invested into by way of weights assigned per market capitalization to ensure liquidity and lower risk. Dividends earned on the stocks are duly deposited to the investors.

Vivekam will alert investors too if the basket has appreciated enough and the underlying scope to grow from current levels is saturated.

Minimum Investment Size is Rs 50,000. -

Wifty is Vivekam’s solution to investors looking to invest only in Large Cap stocks and with low risk appetite. Investors seeking to gain exposure into equities but with need for higher safety and liquidity can do so with Wifty.

Indices like Nifty 50 and Sensex comprise of stocks that are most representative of broad economy through listed stocks who are rated high in terms of liquidity, market capital, volume traded, etc. These stocks relatively have a lower risk/volatility and therefore the scope of returns is lower compared to mid and small cap companies.

Vivekam believes that not every stock in the Nifty 50 has strong fundamentals and great potential to grow. Wifty is designed to have all the positives of Nifty 50 while eliminating the bad apples in the index.

The idea is to analyze the 50 stocks and hold only those stocks that are growing. Like the rest of our equity products, the objective is to generate alpha. Once bought, stock should continue to be held in portfolio unless the results turn bad in subsequent quarters or the stock is taken off the Index.

Portfolio are rebalanced 30 days after quarter end in a staggered manner to ensure investors portfolio only has growth stocks. This product is ideal to clients who are nervous about the direction of the market in general and mid-caps or small-caps in particular.

Minimum Investment Size is Rs 10 Lakhs. -

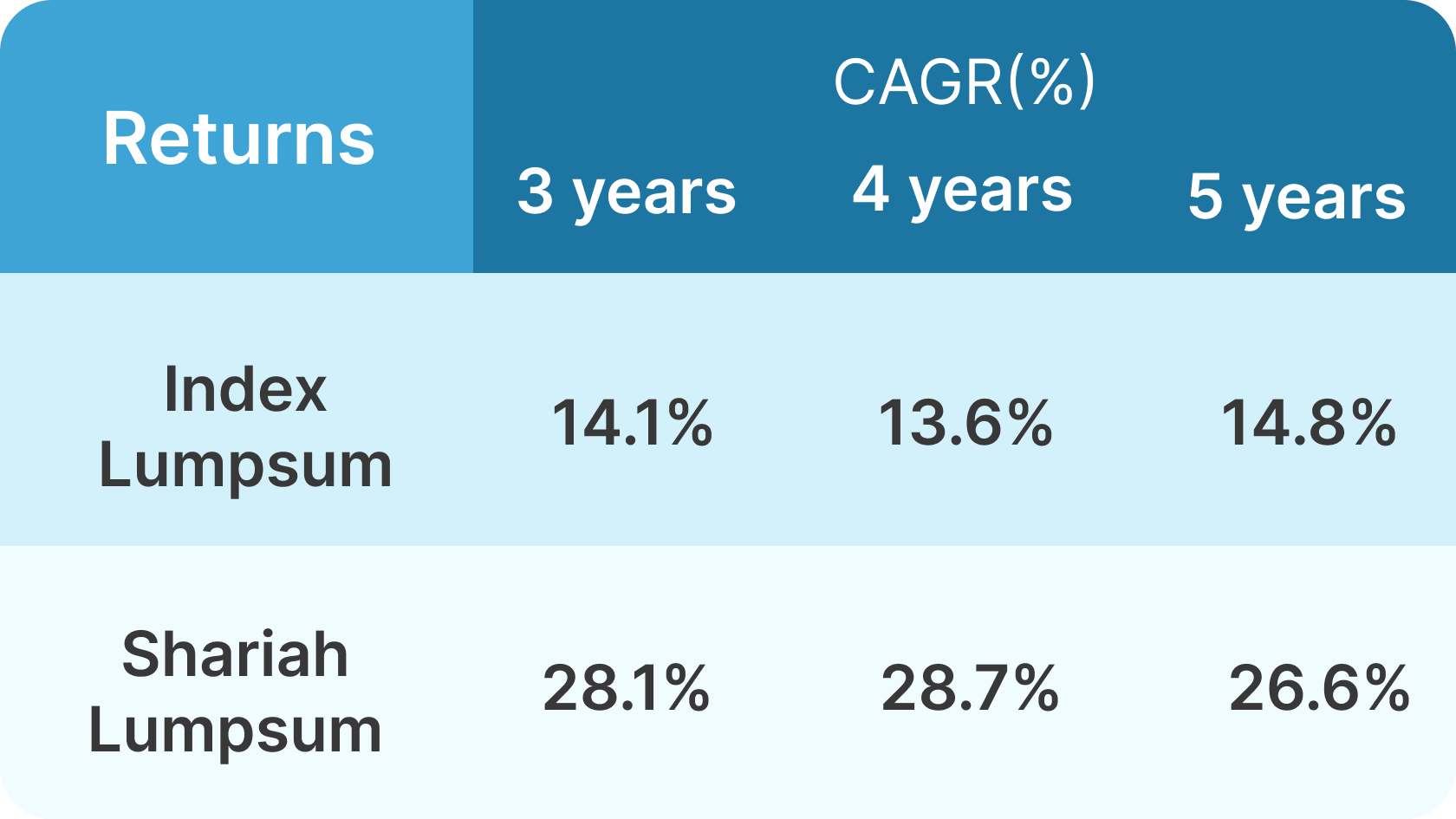

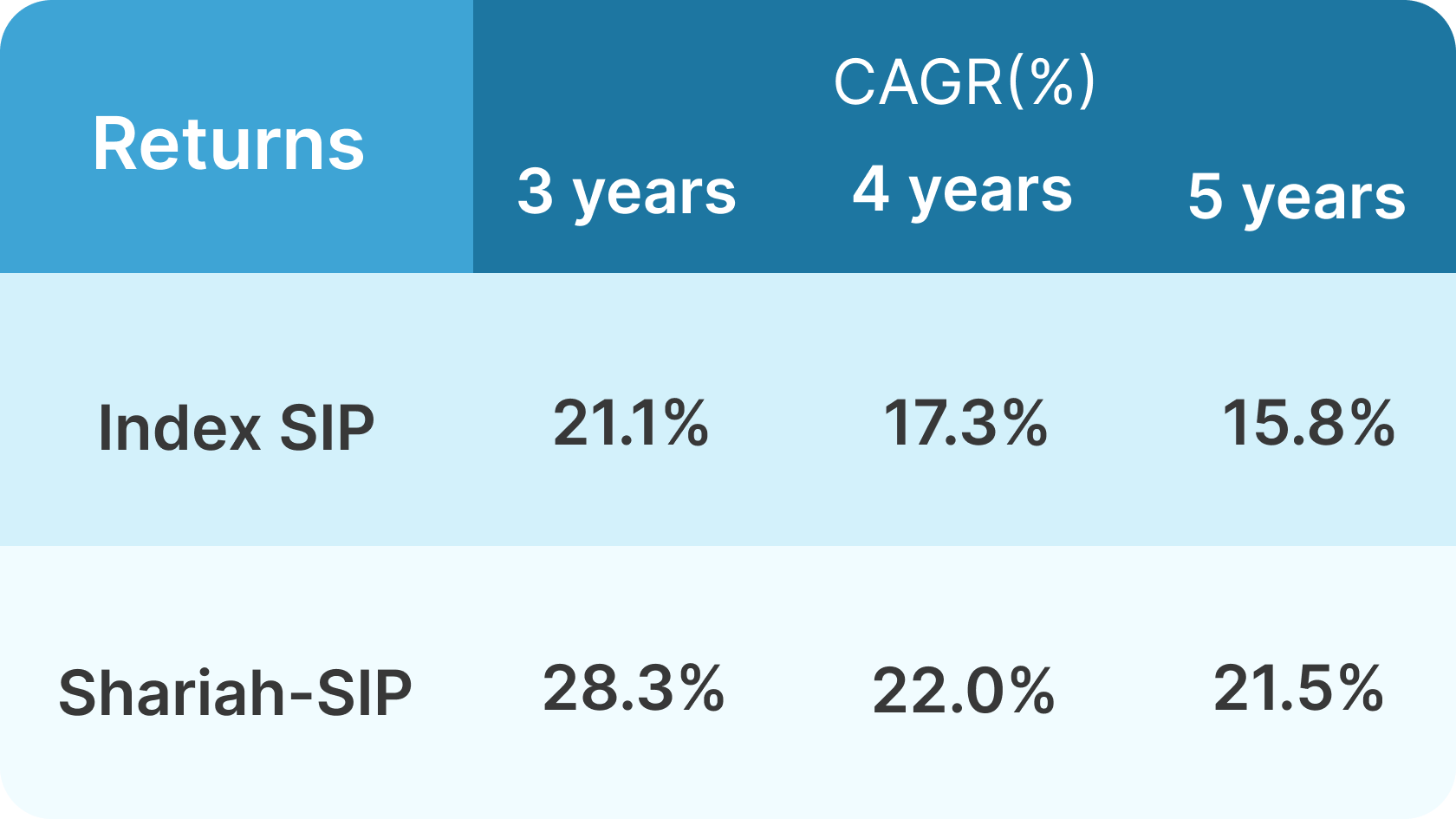

Being one of India’s most trusted Financial Advisors offering top-notch Investment products, Vivekam has developed industry-leading Sharia Compliant products to cater to the growing Islamic Finance industry. Now, individual and Corporate investors adhering to Sharia principles can invest and earn from select Sharia Compliant stocks.

Many principles and norms are applied while selecting Sharia Compliant stocks. For example, stocks from certain sectors like Alcoholic Beverages, Tobacco, and Firearms are avoided according to Sharia principles. Against, a strict filtering process is applied in the case of earnings from certain internet-based transactions.

Vivekam Sharia products only deal in only those stocks which are approved by TASIS (Mumbai). Most importantly, Vivekam’s basket of Sharia Compliant stocks is delivering superior returns over time!.

Minimum Investment Size is Rs 50,000. SIP (Monthly) version i.e Shariah - SMILES has a Minimum Investment Size of Rs 5,000.

Stocks

Equity Products for every Investor

Vivekam Equity Products

Core Competency

Vivekam has developed automated products that allow investors to get direct exposure to publicly traded stocks. These products are our key competency at Vivekam.

All of our products are back tested for at least 20 years. We run simulations as if portfolios have been created each day in the last 20 years to arrive at an analysis on its performance. Unlike other players who follow a model portfolio approach, Vivekam Equity products are all customized, at client level, based on the Investor.

Never Miss out

Our research helps us assert that every stock, sooner or later, shall complete its price discovery process. And a successful investor is one who does not emotionally attach himself to any stock but uses the stock to create wealth for himself.

In-house developed algorithmic logic enables the creation of a portfolio of stocks whose true prices have not yet been discovered by the market. The logic is so designed to identify, periodically review and always keep only stocks that are likely to achieve price growth in the near future.

equity product basket

Equity Products for all types of Investors

The core competency of the logic is to stay with Market Winners and not just Market Leaders. Provided the stock is fundamentally strong, every stock is equally important and relevant. This ensures to drive away emotion, develop discipline and oppose herd behavior – the mantras to successful portfolio strategy!

Convinced with the above stated principles, none of our clients are overtly surprised when 88% of the logic selected stocks have appreciated by more than 10% in 3 months from the date of announcement of quarterly results.

Lumpsum Investments

We have multiple products that allow lumpsum investments. All of our lumpsum products divide investment into four (4) tranches to avoid entry at highs.

- BIO - Growth (Most popular)

- Vivekam Baskets (Theme Based)

- Wifty & Zodiac (Large Cap Only)

- Shariah - Growth (Islamic)

- Inflation Proof Basket

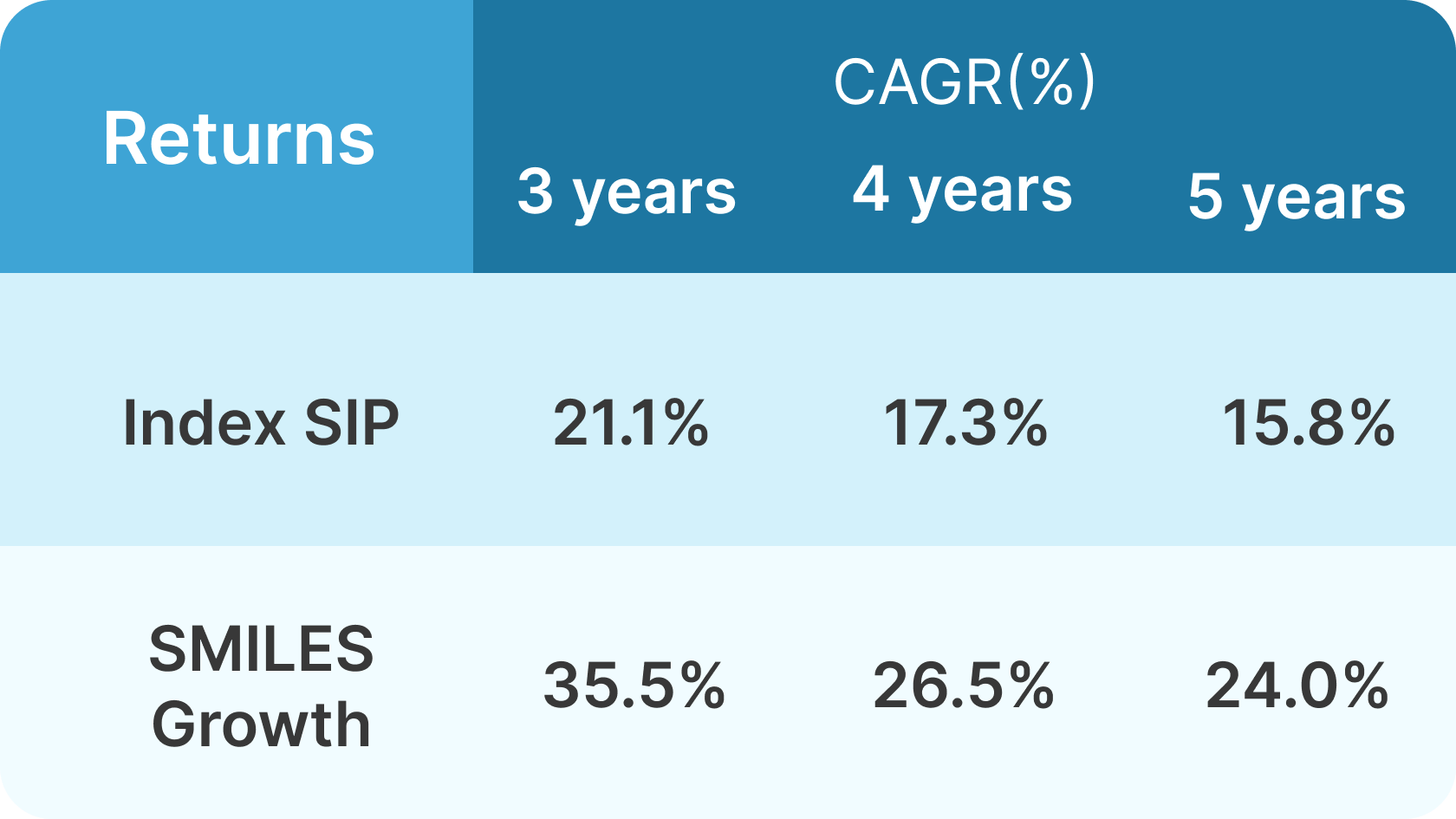

SIP (Monthly) Investments

We have monthly variants to our equity products that allow investors to follow a disciplined approach to investing with infusion at regular intervals.

- SMILES - Growth (Most popular)

- Shariah SMILES (Islamic)