Stress Testing a Portfolio: What It Means & How to Do It

Introduction to Stress Testing in Investment Portfolios

Think of your investment portfolio like a car. It looks shiny, runs smoothly, and gets you where you want to go. But what happens if you slam on the brakes in the rain—or if the road suddenly turns icy? That’s where stress testing comes in.

In finance, stress testing a portfolio is like putting your car through extreme conditions before they happen in real life. You’re not trying to predict the future—you’re making sure you don’t spin out when markets get rough. And here’s the best part: stress testing isn’t just for Wall Street pros. Everyday investors can (and should) use it to protect their hard-earned money.

Why Stress Testing a Portfolio Matters in Modern Investing

Managing Risks During Market Volatility

Markets don’t just move up and down—they swing like a pendulum, sometimes wildly. Stress testing gives you a peek at what might happen if things get ugly, so you’re not left guessing (or panicking).

Identifying Weak Points in Asset Allocation

On paper, you may think you’re diversified—stocks here, bonds there, maybe some real estate. But in a crisis? Many of these assets can move in the same direction. Stress testing exposes those hidden connections so you’re not caught off guard.

Enhancing Decision-Making with Data-Driven Insights

No one likes making blind financial decisions. By stress testing, you swap “gut feelings” for hard data. That makes it easier to rebalance confidently instead of second-guessing every move.

Key Concepts Behind Portfolio Stress Testing

Definition of Stress Testing in Finance

In plain terms, stress testing means asking: “What would happen to my portfolio if the worst-case scenario showed up tomorrow?”

Historical Market Events Used in Stress Tests

This is the “history repeats itself” approach. You replay events like the dot-com bubble, the 2008 crash, or the COVID-19 market plunge, and see how your portfolio would have held up.

Forward-Looking Scenario Analysis

Here’s where imagination kicks in. Instead of just looking back, you simulate “what ifs”—what if oil prices doubled, or inflation spiked, or a major war disrupted global trade? These forward-looking scenarios test your readiness for the unknown.

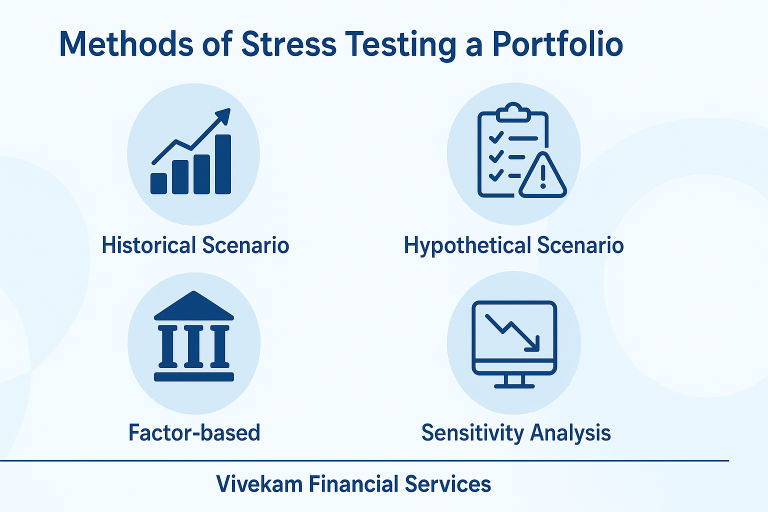

Methods of Stress Testing a Portfolio

Historical Simulation Method

Replay real crises using historical data. Simple, practical, but limited—you can’t test for things that haven’t happened yet.

Sensitivity Analysis Approach

This is the “tweak the dials” method. What if interest rates rose by 2%? What if the S&P 500 dropped by 15%? You adjust one factor at a time and see how your portfolio reacts.

Monte Carlo Simulations

Fancy name, powerful tool. Monte Carlo runs thousands of random scenarios, combining different risks, to give you a range of possible outcomes. It’s like testing your portfolio in alternate financial universes.

Factor-Based Stress Testing

Instead of single events, this method looks at broader forces—like GDP growth, inflation, or unemployment—and measures how shifts in those factors ripple through your portfolio.

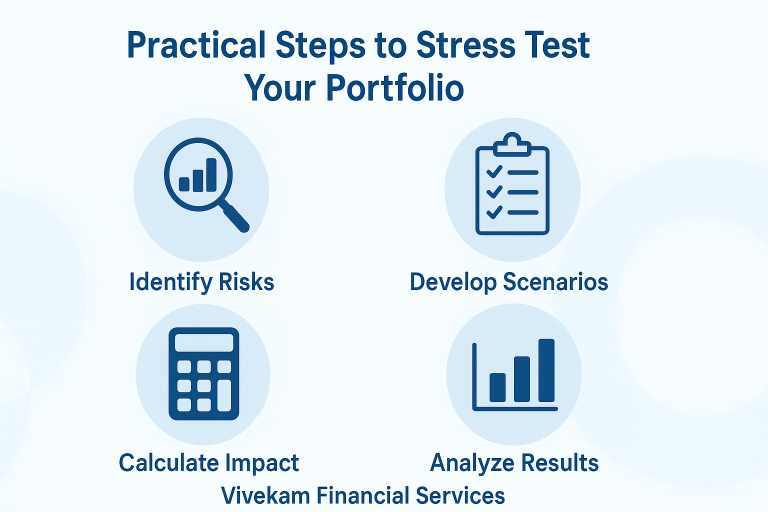

Practical Steps to Stress Test Your Portfolio

Step 1: Define Objectives and Risk Tolerance

Ask yourself: What am I investing for? Retirement? Growth? Safety? Your goals set the stage for which stress scenarios matter most.

Step 2: Gather Portfolio Data

Know what you own, from asset classes to sectors. The more detail you have, the sharper your test results.

Step 3: Select Appropriate Scenarios

Pick crises that could realistically hit your investments. If you own bonds, test an interest rate hike. If you’re heavy in tech, replay a dot-com style collapse.

Step 4: Run Stress Testing Models

Choose the right tool—historical simulations for simplicity, Monte Carlo if you want depth, or factor-based if you’re thinking big-picture.

Step 5: Interpret Results and Adjust Portfolio

The magic is in what you do next. If stress testing shows massive losses, maybe trim risky positions, hedge with safer assets, or rebalance to spread exposure.

Tools and Software for Portfolio Stress Testing

Professional Risk Management Platforms

Institutions lean on heavy-duty tools like Bloomberg PORT or BlackRock Aladdin. They’re powerful but usually pricey.

Broker-Provided Tools

Many online brokers now offer risk analysis dashboards—perfect for retail investors who want quick insights without advanced modeling.

DIY Methods for Individual Investors

Don’t want to spend on software? A simple spreadsheet works. Plug in numbers, test “what if” drops or hikes, and track how your portfolio bends under pressure.

Real-World Examples of Portfolio Stress Testing

Case Study: 2008 Global Financial Crisis

Portfolios stacked with financial stocks were crushed in 2008. Those who had stress-tested a credit crunch scenario might have reduced exposure earlier—and saved themselves huge losses.

Case Study: COVID-19 Market Crash

When markets tanked in March 2020, investors with stress-tested portfolios that included pandemic-like shocks (sharp demand drops, liquidity crunches) were better positioned to ride out the storm.

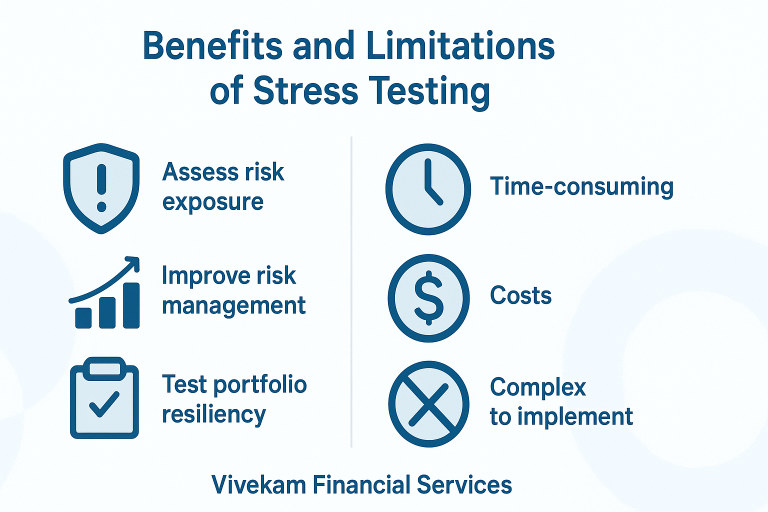

Benefits and Limitations of Stress Testing

Advantages: Better Preparedness and Risk Awareness

- Spots blind spots before they blow up.

- Gives confidence in decision-making.

- Encourages proactive moves, not panic selling.

Limitations: Model Assumptions and Data Accuracy

- Models rely on assumptions—and assumptions can be wrong.

- Stress tests can’t predict “black swans.”

- Historical data doesn’t always prepare you for the next surprise.

Best Practices for Effective Stress Testing

Regular Testing and Scenario Updates

Markets shift constantly. Run stress tests regularly, not just once and done.

Aligning with Investment Goals

A retiree and a 25-year-old investor don’t face the same risks. Your tests should reflect your timeline and objectives.

Combining Stress Testing with Other Risk Measures

Stress testing is one tool. Combine it with diversification, hedging, and Value at Risk (VaR) for a full risk-management toolkit.

Frequently Asked Questions on Stress Testing a Portfolio

1. What is the main purpose of stress testing in investing?

To see how your portfolio might hold up under extreme conditions—and fix weaknesses before they hurt you.

2. How often should I stress test my portfolio?

At least once a year, ideally every quarter, or whenever major economic shifts happen.

3. Can individual investors stress test portfolios without software?

Yes—basic spreadsheets work fine for simple scenarios.

4. How does stress testing differ from value at risk (VaR)?

VaR looks at typical, everyday risks. Stress testing prepares you for extreme, rare shocks.

5. What scenarios should be included in a stress test?

Market crashes, inflation spikes, rate hikes, recessions, and geopolitical conflicts.

6. Is stress testing useful for long-term investors?

Definitely. Even if you’re in it for decades, short-term shocks can derail your journey.

Conclusion: Building Resilient Portfolios Through Stress Testing

Stress testing isn’t about fear—it’s about readiness. By simulating worst-case scenarios, you uncover weak spots, make smarter adjustments, and build a portfolio that’s not just built for sunny days but can weather storms too.

Whether you’re a Wall Street pro or a DIY investor, stress testing should be a regular pit stop on your investing journey. After all, it’s better to face hypothetical crashes today than real losses tomorrow.