57, Road# 71, Jubilee Hills+91-9100009891info@vivekam.co.in

The Adani group news has taken center stage in recent times, with serious allegations against the conglomerate and its partners shaking up the market. These claims have triggered significant corrections in the stock prices of companies under the Adani banner, such as Adani Energy and Adani Green, which saw drops exceeding 20%.

But beyond the headlines, how should investors approach this situation? Let’s dive deeper into the fundamentals and assess the investment landscape.

Recent allegations against the Adani Group, particularly from international entities, have raised questions about financial practices.

However, similar accusations in the past—like those faced by Ericsson and SAP under the Foreign Corrupt Practices Act—resulted in settlements without jeopardizing the core business. Adani, too, might navigate these challenges through penalties rather than operational disruption.

For a group deeply entrenched in infrastructure, energy, and other capital-intensive sectors, continuous funding is essential.

Adani Group’s businesses primarily cater to Indian consumers and government initiatives, ensuring operational stability. However, raising capital in global markets might come with added scrutiny, potentially slowing the process but not halting growth.

The 2023 Hindenburg report caused a significant stir, impacting Adani’s market position. However, the recovery since then has been gradual and less substantial than expected. As investors, the key question remains: should we fear for the group’s stability?

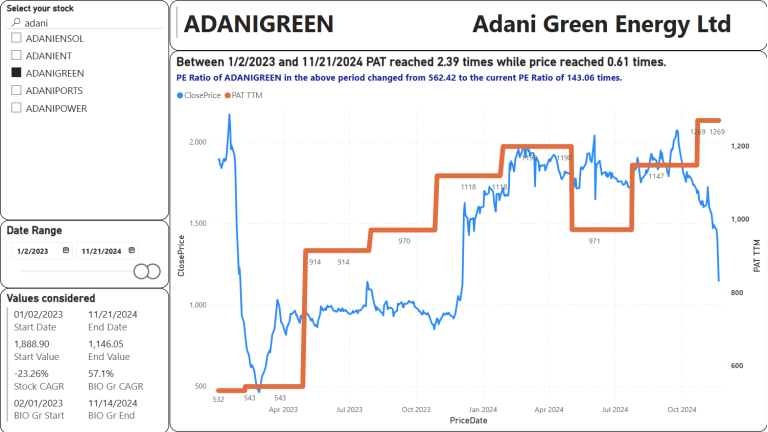

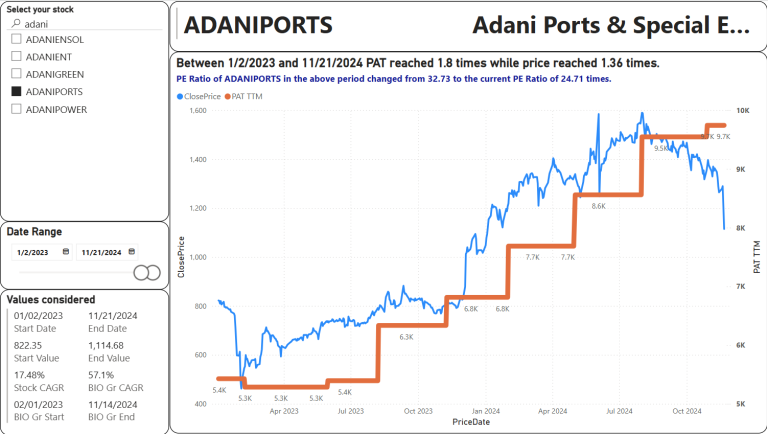

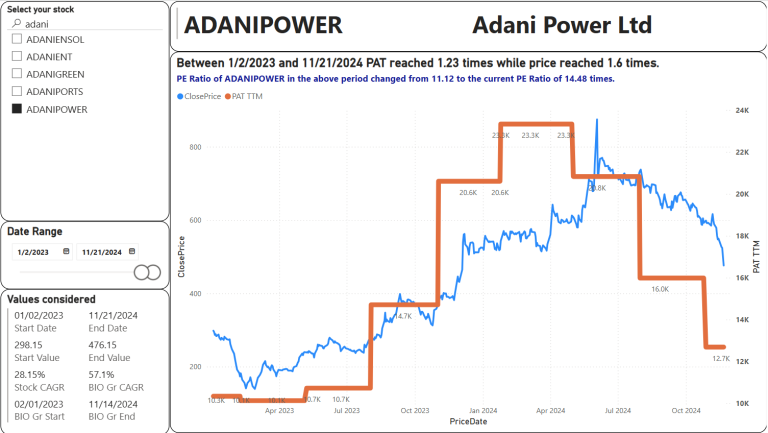

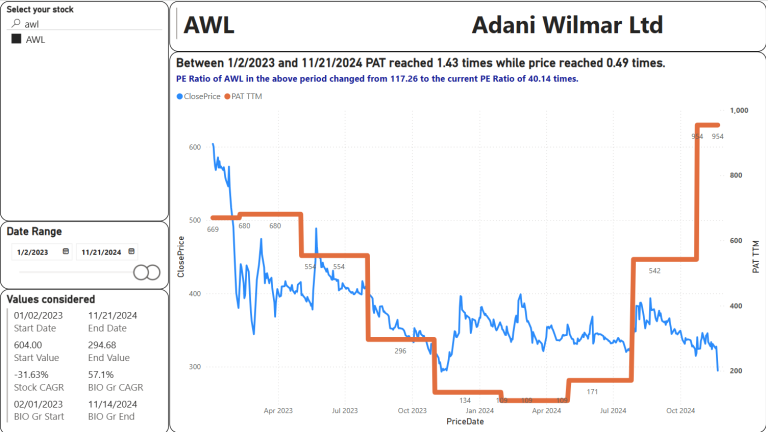

To answer this, a detailed examination of the profits and stock prices of Adani Group companies from the end of 2022 to now (2024) is crucial.

Adani Green, often at the center of controversy, recently announced plans to issue bonds but later canceled them. While mobilizing funds may present challenges, the company’s existing business operations remain robust.

Adani Ports has shown resilience, standing out as a company that has managed to avoid significant setbacks.

Adani Power’s performance has been mixed compared to other group companies.

Adani Wilmar, known for its retail operations, has demonstrated impressive profit growth despite a marginal decline in stock prices.

During the 2023 Hindenburg controversy, concerns about Adani’s debt-to-EBITDA ratio were widely discussed. As of March 2024, the ratio has improved to 2.1x, reflecting better financial management. This indicates that the group is well-positioned to handle its obligations while focusing on growth.

While the Adani Group News has generated global attention, investors need to focus on long-term fundamentals. Allegations may affect sentiment temporarily, but the group’s profit growth and operational stability suggest opportunities for strategic investments.

Rather than succumbing to fear, investors can view the current scenario as an opening to explore undervalued opportunities within the Adani portfolio. Over time, as clarity emerges and the group navigates its challenges, the actual value of its businesses is likely to shine through.

Ready to optimize your portfolio? Click and claim your free financial health check and start a process-driven journey to financial growth. Don’t miss out!

For expert financial guidance and updates, visit Vivekam Financial Services

Email: info@vivekam.co.in

Call us: +91 9100009891

Social Chat is free, download and try it now here!