RBI MPC Meeting 2024: Repo Rate Remains Unaltered, Focus on Growth and Inflation

The global economic landscape is a complex interplay of various factors, with central bank policies playing a pivotal role. The RBI MPC Meeting was held recently, where key decisions were made that impacted the Indian economy.

Let’s break down what happened.

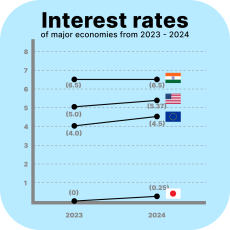

The RBI MPC meeting decided to maintain the repo rate at 6.5% for the seventh consecutive time. This consistent stance comes amidst an inflation rate hovering around 4% and a projected growth forecast of 7.2% for the financial year.

Is this the right move? Let's dive in and find out

Global Economic Scenario :

Let’s take a broader perspective. The global economy is like a puzzle; everyone is trying to find the right pieces.

Countries like the United States and the Eurozone have implemented interest rate hikes to combat rising inflation, leading to concerns about economic slowdown. Conversely, the Bank of Japan’s surprise rate hike has introduced new uncertainties into the global financial system.

Balancing Act: Growth vs. Inflation

In this context, the RBI’s decision reflects a cautious approach amid uncertainty.

It’s clear that India is not immune to these global challenges. Growth in our country has slowed, and unemployment is on the rise.

However, the RBI’s primary role isn’t to dictate economic outcomes but to manage monetary policy effectively and control inflation.

This is why the RBI has set a target of 4% for inflation, a goal made more challenging by the recent increase in food prices.

Bank of Japan's Rate Hike Affects Global Markets

Japan did something unexpected. They decided to raise their interest rates by 0.25%. This might not sound like a big deal, but it caused a real shake-up in the global economy.

Borrowers who had previously enjoyed near-zero interest rates suddenly faced a 7.5% increase in repayment costs, leading to a global sell-off and market turmoil.

Future Outlook for Indian Economy Amidst Global Challenges

Fortunately, India’s exposure to yen-denominated loans is minimal, shielding our market from the worst impact.

This situation underscores the importance of focusing on interest rate costs. Whether we like it or not, these rates profoundly impact economic stability.

The situation in Japan, where the stock index saw drastic fluctuations—falling by 15% one day and rising by 10% the next

This shows us just how connected the global economy is. Even a small change in one place can have huge effects everywhere else

Conclusion: Implications of RBI’s Current Monetary Policy

The RBI’s decision to hold the repo rate steady is a strategic move aimed at fostering a conducive environment for economic growth while keeping inflation in check.

As the global economy continues to evolve, the central bank must remain vigilant and adaptable in its monetary policy stance.