57, Road# 71, Jubilee Hills+91-9100009891info@vivekam.co.in

Recent market fluctuations have left investors feeling uneasy, raising concerns about potential unknown factors. It’s essential to remember that informed decisions are rooted in data, not speculation.

Understanding the Fiscal Deficit : Let’s start with the big picture. This year, the fiscal deficit stands at 8.1%, partly due to limited government spending during the election period. This cautious approach leaves ample room for increased spending in the coming months, which could boost sectors like construction, housing, and infrastructure. These investments are crucial and still in the pipeline.

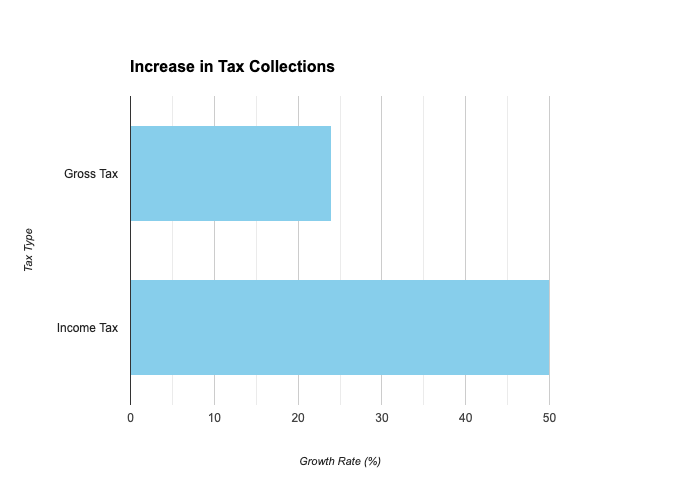

On a brighter note, tax collections tell a different story.

Gross tax collections : Increased by around 24%

Income tax collections : Surged by approximately 50%.

So, while the market might be a bit jumpy, let’s not panic just yet. This correction isn’t a big deal.

By examining these numbers, we can form a collective opinion on the current state of the market and how corporate India is performing, which we will explore further in this blog.

Government Spending and Future Prospects : As discussed, the government has been cautious with spending. However, this trend is expected to change in the upcoming quarter. The government has committed to keeping the fiscal deficit within a range of 4.8% to 4.9% for the overall budget.

With elections behind us, the anticipation of increased investments in sectors like construction, housing, and infrastructure brings a ray of hope for future growth.

Now, it’s clear that government finances are not to blame for recent market corrections.

Let’s shift our focus to corporate India.

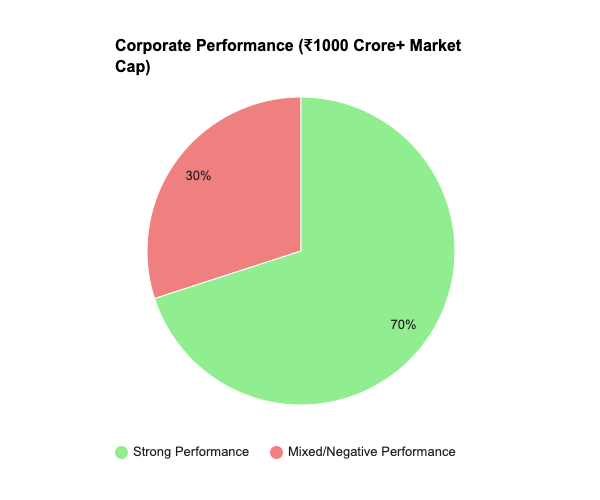

To our surprise, there’s no significant financial damage among major corporations.

Here’s a visual representation of the performance of the 562 major corporations with a market cap of ₹1000 crore or more that have recently released their results:

Based on the strong performance of the majority of these 562 companies, we can confidently say that there is no major disappointment in corporate performance.

Now, you might be wondering about finding good investment opportunities. Historically, the advice has been to buy solid companies at lower costs.

You might ask, “How can we find such opportunities when prices seem to be rising?”

Well, the good news is, there are plenty of opportunities out there. We’ve identified around 70 companies that are trading at a discount of about 30%. These companies are not only affordable but also perform well.

So, don’t let recent market corrections deter you. There are plenty of opportunities to capitalize on, even if some companies have reported stellar results.

There are opportunities in the market every time, especially if we focus on the long term. With around 70 promising companies still available, it’s a positive sign.

For expert financial guidance and updates, visit Vivekam Financial Services

Email: info@vivekam.co.in

Call us: +91 9100009891

Social Chat is free, download and try it now here!